# Rising Tesla Prices: What It Means for Consumers and the Market

Written on

Chapter 1: Understanding Tesla's Price Increases

The cost of owning a Tesla is climbing, moving further away from the goal of being an affordable electric vehicle that competes with traditional internal combustion engine (ICE) cars. In recent days, we've seen significant price hikes across the entire Tesla lineup.

Recent reports indicate that just this Wednesday, Tesla implemented its second price increase within a short period. Previously, we discussed adjustments to the Model 3 and Model Y, but now all models are affected.

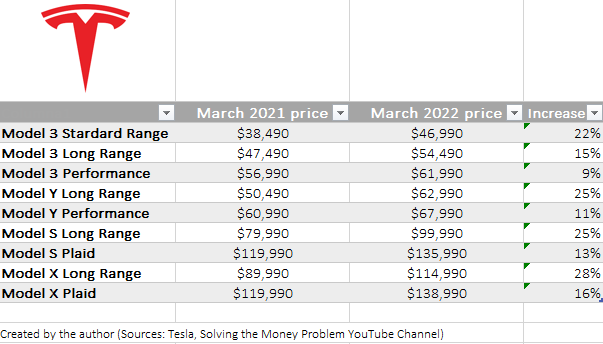

To illustrate, let’s take a look at how much prices have changed over the past year:

The data reveals a wide range of price increases, from 9% for the Performance Model 3 to a staggering 28% for the Long Range Model X. This trend suggests two immediate outcomes for the company:

- New customers who are sensitive to pricing may hesitate to purchase a Tesla.

- The company is likely to see an uptick in revenue over the coming quarters.

Section 1.1: Delivery Times and Customer Impact

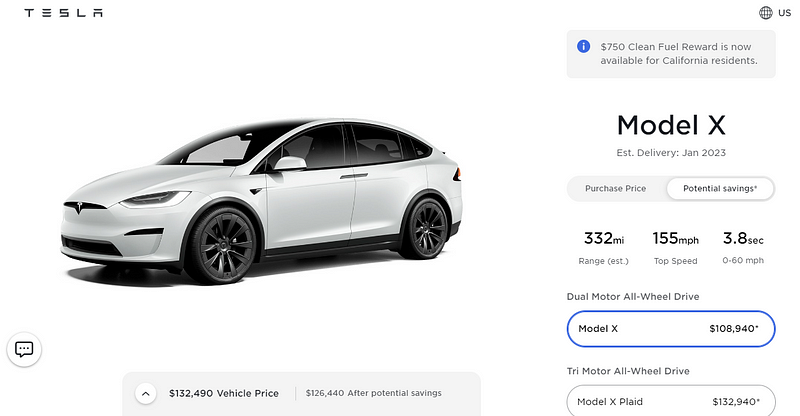

In recent months, delivery timelines for Tesla vehicles have been extending, with some models now having wait times approaching a year. For instance, customers ordering a Model 3 or Model Y with specific configurations might not see their vehicles until late 2022, while buyers of the Model X Long Range could be waiting until January 2023—nearly ten months.

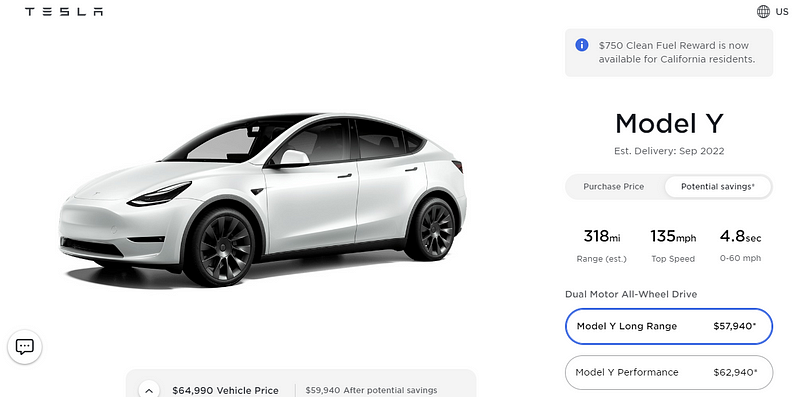

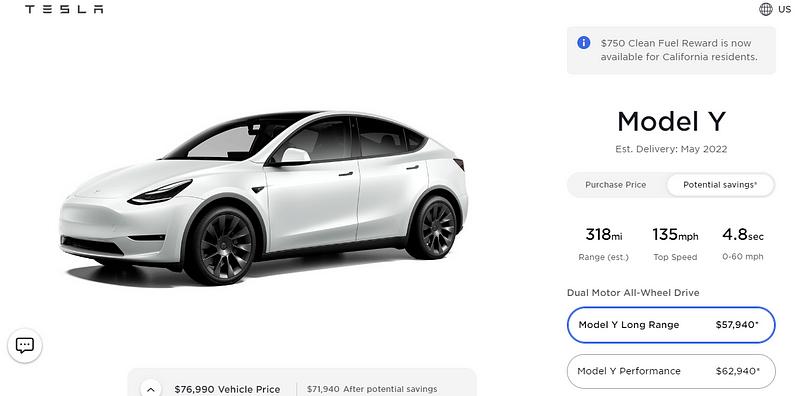

In this snapshot from March 16, 2022, we observe that the Model Y and Model X have standard configurations with delivery times of 6 and 10 months, respectively. Long wait periods can deter potential buyers and diminish overall customer satisfaction, as most people prefer quicker access to their new vehicles.

The current market is tight, with limited inventory available. In contrast, purchasing an ICE vehicle typically allows for immediate delivery, sometimes within days, especially if the buyer is flexible regarding configurations.

Furthermore, second-hand vehicle prices have surged due to a semiconductor supply shortage.

Section 1.2: The Financial Implications for Tesla

Tesla's strong brand equity enables it to raise prices without losing all customer interest. However, with each price increase, the company risks distancing itself from consumers who hoped for more affordable options. Ultimately, a price reduction may be necessary to broaden Tesla's market reach, but that moment hasn’t arrived yet.

The immediate effect of these price hikes is likely an increase in Tesla’s revenue. Higher average selling prices generally translate to greater revenue. However, the question remains: will this boost also enhance profit margins?

It appears the primary motivation behind the price increases is to manage demand. The ongoing supply chain crisis and geopolitical tensions have driven up raw material costs, including aluminum, nickel, and lithium. While this could inflate expenses, it’s probable that Tesla has long-term contracts with suppliers to mitigate price fluctuations.

These advantages of mass production and economies of scale favor Tesla, which has already optimized its manufacturing processes, unlike newer entrants and traditional auto brands that are still ramping up their electric vehicle production.

Additionally, by prioritizing deliveries of higher-end configurations—like Full Self-Driving (FSD) options—Tesla can improve its profit margins, which is beneficial for investors but not necessarily for consumers.

For instance, a captured simulation from March 16, 2022, shows that opting for FSD can significantly reduce wait times for the Model Y, saving buyers four months despite the vehicle remaining unchanged.

Chapter 2: The Future of Tesla Pricing

As long as Tesla continues to increase production to meet demand, it seems unlikely that prices will decrease. Only once production levels are sufficient and processes refined can we expect Tesla to lower prices to attract a broader customer base and advance its mission: “to accelerate the world’s transition to sustainable energy.”

In the upcoming year, with new facilities in Berlin and Austin, along with increased output from Fremont and Shanghai, Tesla's production is set to rise significantly. However, it’s uncertain whether this will be enough to meet the high demand.

Even in subsequent years, with the introduction of a new, more affordable vehicle, demand may still outstrip supply, particularly in markets like Europe and China.

In conclusion, I believe we won't see significantly lower prices for Tesla vehicles for at least five to six years, especially as other manufacturers begin to ramp up their electric vehicle production and the market stabilizes.

If you found this information valuable, consider reading:

- Is GigaBerlin production underestimated on purpose by Tesla?

- Comments from Elon Musk and statements from the investor calls suggest that production capacity for the recently opened…