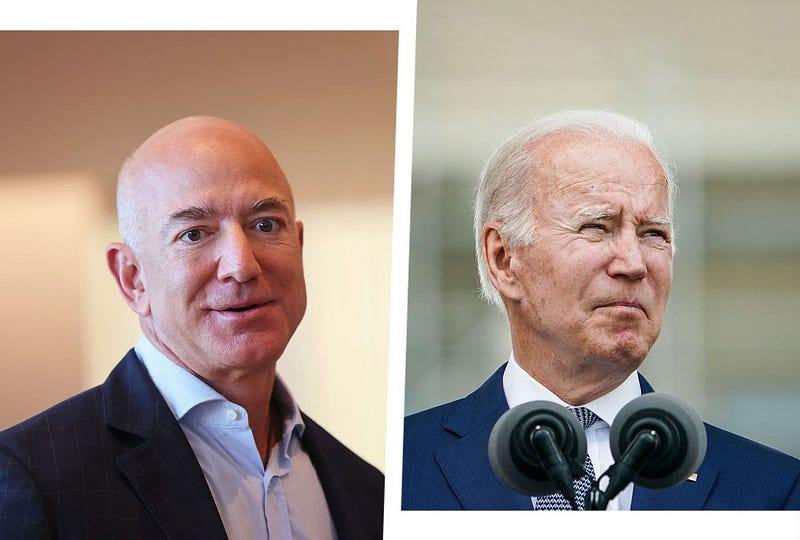

# Biden vs. Bezos: Higher Taxes on the Wealthy Could Fuel Inflation

Written on

Understanding the Impact of Taxation

In the ongoing discourse between the Biden Administration and Amazon's CEO Jeff Bezos, President Biden has expressed a desire to hike taxes on affluent Americans to mitigate inflation. However, overburdening the wealthy with taxes could potentially worsen inflation instead of alleviating it.

“@JeffBezos is mostly wrong in his recent attack on the @JoeBiden Admin,” noted former Treasury Secretary Larry Summers, a progressive Democrat who has previously critiqued Biden's fiscal policies. He tweeted in support of Biden's stance, advocating for progressive tax increases to curb demand and control inflation.

The Flawed Logic of Taxing the Wealthy

Despite the administration's intentions, imposing higher taxes on wealthy individuals may not effectively reduce demand; rather, it risks diminishing supply, ultimately exacerbating inflation. The only scenario where increased taxes could lower demand would be if it led to decreased consumption. However, raising taxes on high-income earners will likely not curtail their spending but will instead diminish their savings. This is crucial since savings play a vital role in capital formation which is necessary for future economic growth.

Household Financial Dynamics

Every household allocates its income into three primary areas: taxes, necessities, and discretionary spending. After fulfilling tax obligations—such as personal income taxes, Social Security, and Medicare—what remains is disposable income. Households have two main options for this income: they can either spend it on goods and services or save it for future investments.

Lower-income families typically exhaust their disposable income to maintain their living standards, while higher-income households spend significantly but still manage to save, which contributes to their wealth accumulation.

The Impact of Tax Increases on Consumption

It's true that increasing taxes on lower-income households would lead to decreased consumption, thereby lowering demand and inflation. However, President Biden's focus is on taxing the wealthy, who are perceived to be "not paying their fair share."

Even with higher taxes, affluent individuals are likely to maintain their consumption levels to preserve their lifestyles. As a result, demand would remain unchanged, failing to impact inflation. Instead, the wealthy might cut back on their savings, leading to diminished capital formation. This scarcity of capital would hinder business growth, ultimately resulting in decreased supply over time and aggravating inflation.

Misleading Statements from the Administration

Deputy White House Press Secretary Andrew Bates commented, “It doesn’t require a huge leap to figure out why one of the wealthiest individuals on Earth opposes an economic agenda for the middle class that cuts significant family costs, combats inflation long-term, and contributes to the historic deficit reduction the President is achieving by ensuring the richest taxpayers and corporations pay their fair share.”

This perspective is misleading. The Biden Administration's policies, which have overly stimulated the economy, are a significant contributor to the current inflationary crisis—a point even Summers concurs with. As inflation disproportionately affects lower-income households and those on fixed incomes, Biden’s economic initiatives are more harmful than beneficial to the middle class.

Budgeting for the Future

This year, the federal deficit is projected to decline from the second-highest level ever recorded to the third-highest. To achieve genuine deficit reduction, the Biden Administration must prioritize cutting government spending.

Biden has yet to clarify what constitutes a "fair share." Currently, the top 10% of earners contribute over 71% of all federal income taxes collected. Is this not a fair contribution? Biden's goal is to increase their share.

However, making income tax rates more progressive could undermine capital formation, resulting in higher inflation instead of alleviating it.

Time for a New Approach

It is crucial to move past the contention and ensure that all American income earners contribute equitably. A plan exists that addresses this need.