Investing in Fusion Energy: A Guide to Future Opportunities

Written on

Understanding Fusion Energy

Investing in fusion technology is a long-term endeavor that presents opportunities for substantial returns. As a developing sector, fusion energy holds the promise of being as transformative for this century as coal was in the 1800s and oil in the 1900s. If successful, this groundbreaking technology could integrate seamlessly into the global infrastructure, creating vast investment opportunities. If you're curious about how this innovative energy source can impact your financial future, keep reading.

Exploring Nuclear Fusion

Nuclear fusion involves generating electricity by merging two atomic nuclei to create a new one. This process releases energy due to a slight loss of mass, attributable to the weak nuclear force that binds subatomic particles. Each atom has its own binding energy, and when two nuclei combine, the surplus binding energy is released as energy, resulting in heat during the fusion reaction.

Fusion differs from fission, where a large nucleus splits into smaller ones. While fission is rarely observed in nature on a large scale, fusion fuels stars. By enhancing our grasp of nuclear fusion, we aim to unlock its potential as a sustainable and abundant energy source for future generations.

Advantages of Fusion Energy

Fusion energy boasts numerous benefits compared to fission. Firstly, it is inherently safer—once a fission reaction is initiated, it requires careful control to prevent catastrophic failures. In contrast, fusion can cease simply by stopping the fuel supply. Furthermore, fusion produces helium, a harmless gas, while fission generates hazardous radioactive waste.

Additionally, fusion uses isotopes of hydrogen, which are abundant, whereas fission relies on rare and costly enriched uranium. Fusion reactors can produce significantly more energy—four times that of current fission plants and four million times that of traditional coal or oil facilities—demonstrating its unparalleled power generation capabilities.

Challenges in Fusion Technology

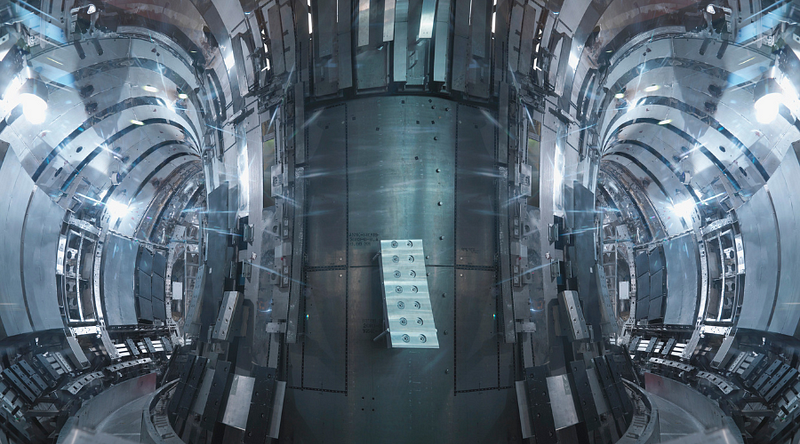

The heart of a fusion reaction is often described as "the bottle." Currently, it's impossible to contain even the smallest stars within a physical reactor, as any solid material would vaporize instantly. Instead, fusion occurs in high-energy plasma held by powerful magnetic fields that form the "bottle," maintaining safety and efficiency.

The challenge is that, with current technology, maintaining this magnetic bottle consumes more energy than the fusion reaction produces. As temperatures rise, so does the energy required for confinement, leading to a negative net energy output. However, advancements in various fields are improving the efficiency of this process, and there are claims of achieving a positive net energy output in recent experiments.

Investing in Fusion Technology

Investing in fusion technology presents challenges. As it’s still developing, any investment in this area is speculative. Currently, no publicly traded companies operate fusion reactors since they are still theoretical. However, the industry has garnered over $4 billion in investments, largely from government and university labs, alongside private startups like Helion Energy and Commonwealth Fusion Systems, which have attracted significant funding.

For individual investors, direct investment in these companies is not feasible, but there are alternatives.

General Fusion Investment Options

One approach is to invest in publicly traded firms that have stakes in fusion companies. Major technology players like Alphabet and Amazon are investing in fusion research firms. Additionally, notable companies such as Babcock International and Cenovus Energy have also joined the trend.

Investing in these companies could yield benefits if their investments pay off. Alternatively, consider investing in the S&P 500, as many companies will benefit from the efficiencies and cost savings brought by fusion technology.

Nuclear Energy Stocks and Long-term Strategies

Fusion is fundamentally an energy sector investment. Those interested in this market should adopt a long-term strategy. Consider investing in energy companies like Chevron, utilities such as Duke or National Grid, or energy-focused funds like the Vanguard Energy ETF or Global X Renewable Energy Producers. Given the current stage of fusion technology, this approach is more suitable for retirement portfolios rather than short-term gains.

Investing in Fusion Resources

Investing in fusion-related resources can be lucrative. Fusion relies on hydrogen isotopes—deuterium and tritium—primarily sourced from water. Companies specializing in desalinization are essential, as hydrogen isotopes are typically produced from seawater.

To explore potential investment opportunities, look into firms producing deuterium gas, and consider those manufacturing materials crucial for reactor construction, such as superconductors, mercury, titanium, and cutting-edge ceramics.

Conclusion and Next Steps

The evolution of fusion technology offers significant potential for future investments. While direct investments may not be possible, alternative paths exist. Research companies involved in fusion development and those operating within the energy sector. Collaborate with a qualified financial advisor to create a robust investment strategy tailored to your financial goals and risk tolerance. Given that fusion technology is still emerging, long-term investments will be key for those looking to capitalize on this promising industry.

This video discusses the importance of investing in fusion energy research and its potential impact on global energy solutions.

This video explores the current state of fusion energy investment and global collaboration efforts in 2024.